There are two main ways to Make Money from Bonds. One way is to purchase bonds directly from the issuing company. This can be done through a broker or dealer. Another way is to purchase bonds indirectly through a mutual fund. This can be done through a broker, dealer, or mutual fund company. Other than this, there are 6 more ways to make money from bonds, as a bonus I have explained each method in this article.

Before all that, you need to understand what is a bond, how bonds work and how to invest in bonds to become a millionaire.

You may also like: 37 Best Apps to Make Money on Android Phone in 2023

What is a Bond?

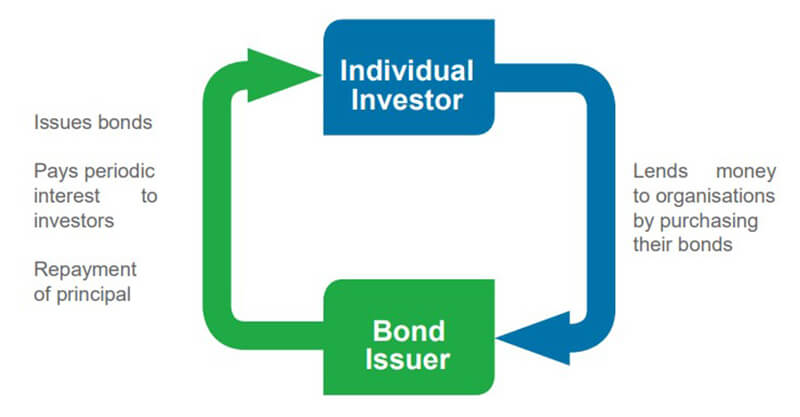

Before start Make Money from Bonds, you need to understand, what is a bond? A bond is a debt security, typically issued by a government or corporation in order to raise capital. Investors who purchase bonds are effectively lending money to the issuer, who promises to repay the debt over a set period of time. Bonds typically pay periodic interest payments, known as coupons, to the bondholders. At maturity, the issuer repays the face value of the bond to the bondholders.

Bonds are an important part of the financial markets and are used by governments, corporations, and individuals to raise capital. Bonds are often used to finance infrastructure projects, such as the construction of roads and bridges. They can also be used to finance other capital expenditures, such as the purchase of equipment or the expansion of a business.

Bonds are a relatively safe investment, as the issuer is typically obligated to repay the debt regardless of the financial performance of the underlying project. However, bonds can be risky if the issuer defaults on the debt, which can lead to the loss of the investment.

Typical bond issuers include:

- Sovereign entities

- Governments/Government agencies

- Banks

- Non-bank financial institutions

- Corporations

How to Invest in Bonds.

How do Bonds Work?

Bonds are a type of debt instrument used by corporations and governments to raise capital. When an investor buys a bond, they are effectively lending money to the issuer, who agrees to repay the debt with interest. The interest payments are known as coupons, and the bond itself is a promise to repay the debt.

The key feature of a bond is that it has a fixed term, meaning that the issuer is obliged to repay the debt on a set date. This makes bonds a relatively low-risk investment, as the investor knows exactly when they will get their money back. However, it also means that bonds are not as flexible as other investments, such as stocks.

Another important feature of bonds is that they are typically issued in denominations of $1,000. This makes them accessible to a wide range of investors, as most people can afford to buy at least one bond.

Bonds are an important part of the global financial system, and are used by both corporations and governments to raise capital. For investors, they offer a relatively low-risk way to earn interest payments.

Corporations

- Cash for operating expenses

- Capital for growth and expansion

- Funds for corporate acquisitions

Government Treasury

- Cash for budgeted national expenditure

- Funds for repayment of national debt

States, Cities, Townships

- Cash for operating expenses

- Funds to build public infrastructure

(for example, roads, housing, parks)

What Types of Bonds?

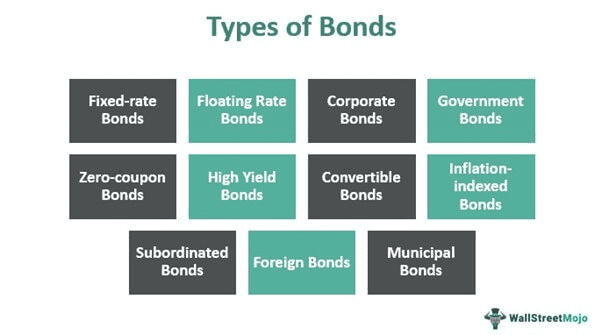

Bonds are differentiated by their varying payment features

Fixed-rate bond

A fixed-rate bond is a bond that pays a fixed rate of interest over the life of the bond. The interest rate is set at the time the bond is issued and does not change over the life of the bond. Fixed-rate bonds are typically issued with maturities of 5 years or more.

Floating-rate bond

A floating-rate bond is a type of bond that has a variable interest rate. The interest rate on a floating-rate bond is typically tied to an underlying benchmark rate, such as the prime rate or LIBOR. This means that as the benchmark rate changes, so does the interest rate on the bond.

Subordinated bond

A subordinated bond is a debt security that ranks below other debt securities with respect to claims on assets or earnings. In the event of bankruptcy, subordinated bondholders are paid only after senior bondholders have been paid in full. Subordinated bonds are also known as subordinated debentures or junior debt.

Convertible bond

A convertible bond is a type of debt security that can be converted into common stock or cash at the option of the holder. The conversion price is typically set at a premium to the market price of the underlying stock, providing the holder with an upside potential if the stock price increases. Convertible bonds are often used by companies as a way to raise capital without having to issue new shares, and they can be an attractive investment for investors seeking higher yields.

TIPS (Treasury Inflation Protected Securities)

Treasury Inflation Protected Securities (TIPS) are a type of government bond that offers protection against inflation. The principal and interest payments on TIPS are adjusted for inflation, so the bondholder always receives the original value of the investment, plus any inflationary gains. TIPS are a popular choice for investors who want to hedge against inflation, and they can be an attractive addition to any portfolio.

Zero-coupon bond

A zero-coupon bond is a debt security that doesn’t pay periodic interest payments and instead pays one lump sum at maturity. The bond’s face value is the amount of money that will be paid at maturity, and the bond’s price is the present value of that future payment, determined by discounting at an interest rate. Because zero-coupon bonds don’t make periodic interest payments, they are sold at a deep discount from face value.

Why Invest in Bonds?

Bonds are often seen as a safe investment, as they tend to be less volatile than stocks. This makes them a good choice for investors who are risk-averse or who are looking for a steady stream of income.

Another reason to invest in bonds is that they can provide diversification for your portfolio. This is because bonds tend to move in the opposite direction of stocks, so they can help to balance out your portfolio and reduce your overall risk.

Finally, bonds can be a good way to preserve your capital. This is because bonds typically have a lower rate of return than stocks, but they also tend to be less risky. This means that you are less likely to lose money in a bond investment than in a stock investment.

What are the Risks?

Bonds are generally considered to be a safe investment, but there are still some risks associated with them. The most common risk is interest rate risk, which occurs when interest rates rise and the value of your bonds falls. This can happen if you invest in bonds with a fixed interest rate, and rates in the market rise above that rate.

Inflation risk is another potential risk, as it can reduce the purchasing power of your bonds’ interest payments and principal. Credit risk is also a possibility, as bonds can lose value if the issuer experiences financial difficulties. However, if you diversify your bond portfolio and invest in high-quality bonds, you can minimise your risk.

You may also like: How to Make Money on Bigo Live (10+ Proven Ways) 2023

How to Make Money from Bonds.

There are two ways that investors Make Money from Bonds. The individual investor buys bonds directly, with the aim of holding them until they mature in order to profit from the interest they earn. They may also buy into a bond mutual fund or a bond exchange-traded fund (ETF).

1. Collecting Interest Income

Bonds are a fixed-income investment, meaning they provide a set stream of payments over time. When you purchase a bond, you’re lending money to a borrower in exchange for regular interest payments. The payments are typically made semi-annually, meaning you’ll receive interest twice a year.

To collect your interest income, you’ll need to hold the bond until it matures. Maturity is the date when the bond’s principal is repaid in full. When the bond matures, you’ll receive your final interest payment along with the return of your original investment.

If you sell the bond before it matures, you may not receive all of your interest payments. That’s because most bonds are sold at a discount, meaning you’ll receive less than the bond’s face value. The closer the bond is to maturity, the less of a discount you’ll typically pay. As a result, it’s generally best to hold bonds until they mature in order to collect all of the interest payments.

2. Generating Capital Gains

Bonds are often seen as a safe investment, but they can also offer the potential for capital gains. When interest rates rise, the prices of bonds fall, and vice versa. So, if you purchase a bond when rates are low and interest rates subsequently rise, you may be able to sell the bond for a profit.

Of course, there is always the risk that rates will fall and your bond will lose value. However, if you do your research and purchase bonds from high-quality issuers, the risk is generally lower.

If you’re looking to generate capital gains from your investments, bonds may be worth considering. Just be sure to do your homework first!

3. How to Make Money with Fixed-rate bonds

A fixed-rate bond is a debt security that pays a predetermined interest rate over the life of the bond. The interest rate is set at the time of issuance and does not change over the life of the bond. This makes fixed-rate bonds an attractive investment for those looking for stability and predictable income.

Investors can purchase fixed-rate bonds through a broker or directly from the issuing company. The bonds are typically issued in denominations of $1,000 and have a fixed maturity date, at which point the bond will mature and the principal will be repaid. Interest payments are typically made semi-annually.

Fixed-rate bonds offer investors a safe and secure investment option. They can be an excellent way to generate income and preserve capital. For these reasons, fixed-rate bonds are a popular choice among investors.

4. How to Make Money with Floating-rate bonds

One way to make money with a floating-rate bond is to invest in a bond that has a higher interest rate than the prevailing market rate. When interest rates rise, the value of your bond will increase, and you can sell it for a profit.

Another way to make money with a floating-rate bond is to invest in a bond that has a lower interest rate than the prevailing market rate. When interest rates fall, the value of your bond will increase, and you can sell it for a profit.

5. How to Make Money with Subordinated bonds

A subordinated bond is a debt security that ranks below other debt securities in terms of priority for repayment in the event of a company default. In other words, subordinated bonds are subordinate to senior debt in the event of liquidation. As a result, subordinated bonds are considered to be higher risk than senior debt, and therefore offer higher yields.

There are a number of ways to make money with subordinated bonds. One way is to purchase them at a discount to their par value and then hold them until they mature. Another way is to purchase them at a discount and then sell them prior to maturity for a profit. Finally, investors can also purchase subordinated bonds and then reinvest the coupon payments in other higher yielding investments.

6. How to Make Money with Convertible bonds

A convertible bond is a type of debt security that can be converted into equity. Convertible bonds are often used by companies as a way to raise capital. They are also used by investors as a way to get exposure to a company without having to buy shares of its stock.

Convertible bonds are typically issued with a maturity date of five to seven years. Interest on the bonds is paid semi-annually. At the maturity date, the bonds can be converted into shares of the company’s stock.

The conversion rate is typically based on the price of the stock at the time the bonds are issued. For example, if a company’s stock is trading at $10 per share and the bonds have a conversion rate of 1:10, then each bond can be converted into 10 shares of stock.

Investors may choose to convert their bonds into stock if the stock price has increased, giving them a profit. Convertible bonds can be a good investment for those who are willing to take on some risk, as they offer the potential for both income and capital gains.

7. How to Make Money with Treasury Inflation Protected Securities.

Treasury Inflation Protected Securities (TIPS) are a great way to invest your money and protect yourself against inflation. TIPS are issued by the federal government and are backed by the full faith and credit of the United States. They are available in terms of 5, 10, and 20 years, and pay interest twice a year. The interest rate on TIPS is linked to the Consumer Price Index (CPI), so it rises and falls with inflation.

TIPS are a great investment for people who are looking to protect their money against inflation. The interest rate on TIPS is linked to the CPI, so it will rise and fall with inflation. TIPS are available in terms of 5, 10, and 20 years, and pay interest twice a year.

8. How to Make Money with Zero-coupon bonds

A zero-coupon bond is a bond that does not pay periodic interest payments, known as coupons, to the bondholder. Instead, the bondholder receives one lump sum payment at maturity. The payment consists of the bond’s principal, which is the face value of the bond, plus any accumulated interest.

Zero-coupon bonds are often issued by governments and government-sponsored enterprises. These bonds are typically sold at a discount, meaning that the bondholder pays less than the face value of the bond. The difference between the purchase price and the face value is the bondholder’s return, or profit.

Zero-coupon bonds can be an attractive investment for individuals who are looking for a way to earn a guaranteed return on their investment. The bonds are also popular with investors who are seeking to diversify their portfolio or hedge against inflation.

You may also like: How to Make Money With Bitcoin (16+ Proven Ways) 2023

How to Buy Bonds: Corporate, Treasury, Municipal, or Foreign

How to Buy Corporate Bonds

Corporate bonds are a type of debt security that allows companies to raise money by borrowing from investors. When you buy a corporate bond, you are lending money to the issuing company and, in exchange, the company promises to pay you interest payments (coupons) and to repay the face value of the bond (principal) when the bond matures.

There are two main types of corporate bonds: investment-grade bonds and junk bonds. Investment-grade bonds are issued by companies with good credit ratings and are considered to be a safer investment. Junk bonds, on the other hand, are issued by companies with poor credit ratings and are considered to be a more speculative investment.

When considering how to buy corporate bonds, you will need to decide what type of bond you want to invest in. You will also need to decide whether you want to buy the bonds directly from the company or through a broker. If you buy the bonds directly from the company, you will usually get a lower interest rate. However, buying through a broker may be more convenient and may give you access to a wider range of bonds.

Once you have decided how to buy corporate bonds, you will need to research the specific bonds you are interested in. You will need to consider the credit rating of the issuing company, the coupon rate, the maturity date, and the yield. It is important to remember that corporate bonds are subject to interest rate risk, credit risk, and market risk.

When you are ready to buy corporate bonds, you will need to open a brokerage account. You can then use the account to buy the bonds directly from the company or through a broker. Once you have purchased the bonds, you will need to hold onto them until they mature. You will then receive your interest payments and your principal, minus any fees and commissions.

How to Buy Government Bonds

Government bonds are a type of debt security issued by the government to raise funds to finance various projects. The bonds are typically issued with a term of 10, 20, or 30 years and have a fixed interest rate. When you purchase a government bond, you are lending money to the government and are entitled to receive interest payments on the bond at regular intervals. When the bond matures, the government will repay the principal amount of the bond.

Government bonds are a relatively safe investment since they are backed by the full faith and credit of the government. However, they are subject to interest rate risk, which means that the value of the bond may fluctuate in response to changes in interest rates. When interest rates rise, the value of bonds falls, and vice versa.

If you are interested in purchasing government bonds, you can do so through a broker or dealer that is registered with the SEC. You can also purchase government bonds directly from the government through its website.

How to Buy Bond Funds

Bond funds are a great way to diversify your portfolio and earn a steady stream of income. Here are a few tips on how to buy bond funds:

- Decide what type of bond fund you want to buy. There are many different types of bond funds, each with its own set of risks and rewards.

- Research the fund. Once you know what type of bond fund you want to buy, research the specific fund you’re interested in. Read the fund’s prospectus and compare it to other similar funds.

- Consider your investment objectives. When choosing a bond fund, make sure your investment objectives are aligned with the fund’s goals. For example, if you’re looking for income, you’ll want to choose a fund that focuses on bonds that pay interest.

- Determine how much you want to invest. Bond funds can be purchased in different denominations, so decide how much you want to invest upfront.

- Buy the bond fund. Once you’ve done your research and decided how much you want to invest, you can purchase the bond fund online or through a broker.

Make Money from Bonds FAQ

Why bonds are not a good investment?

The value of fixed income securities will fluctuate and, upon a sale, may be worth more or less than their original cost or maturity value. Bonds are subject to interest rate risk, call risk, reinvestment risk, liquidity risk, and credit risk of the issuer.

What Is My Risk Tolerance?

Before investing, it’s absolutely vital for investors to perform a risk-disposition self-assessment. The goal is to determine how much risk they can or are willing to take when investing in bonds. Without knowing how much risk you want to take or avoid, an overall strategy cannot emerge. Therefore, several factors must be considered in terms of the investor’s risk profile including:

How Risky is This Bond?

There are numerous risks involved with bonds, especially corporate bonds. Some specific types of risk of primary concern are inflation risk, interest rate risk, liquidity risk, and credit risk. Happily, several management tools exist to assess, analyze and ultimately help investors manage these risks. One of the primary ones is the bond rating, a letter grade assigned by an independent credit rating company to the debt that indicates its credit quality. The better the grade, the less likely the chance of the issuer’s defaulting on the bond.

Can I Keep the Bond Until Maturity?

Investors must consider another significant risk factor with a bond: the chance it is called —that is, bought back before its maturity date. Commonly referred to as the bond’s call risk, this refers to the chance the issuer may redeem the bond at an early date in response to rising market prices or falling interest rates.1 It’s vital, therefore, to determine whether a bond has a call date before its maturity and how likely an issuer is to make good on that call.

In Case of Default, Can I Get Repaid?

Before investing, you should determine whether you are likely to receive your money back (or part of your money) in the event an issuer goes into default or becomes insolvent. Typically, investors will do this both through the determination of two figures: loss given default (LGD) and the recovery rate. Additionally, besides knowing whether or not a bond is secured, it is important to know where it ranks in seniority for other secured bonds in terms of payout—should the issuer become insolvent when do they close during insolvency.

Can the Bond’s Issuer Cover Its Debts?

Keep in mind that companies issue bonds as a way to attract loans, so bond purchasers are lending their funds to the issuer. Therefore, just like they would when assessing anyone they offer a loan to, investors should make sure the issuer is prepared to make good on the payments and principal promised at maturity. This isn’t simple, as it requires constant monitoring as well as an in-depth analysis by qualified professionals.